IRS 2758 2004-2026 free printable template

Show details

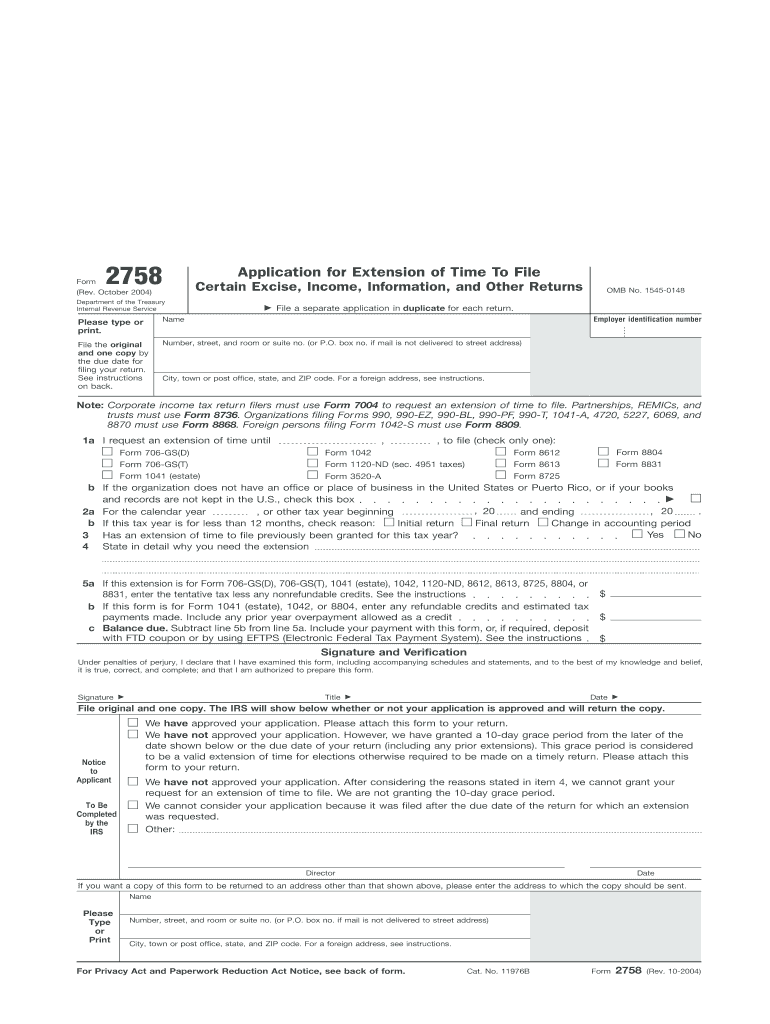

If your mailing address has changed since you filed your last return use Form 8822 Change of Address to notify the IRS of the change. A new address shown on Form 2758 will not update your record. Line 1a. Check only one box. You must file a separate Form 2758 for each return for which you are requesting an extension. Line 1b. When to file. File Form 2758 by the regular due date or the extended due date if a previous extension was granted of the return for which an extension is needed. However...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign printable tax forms

Edit your irs form 706 due date form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 2758 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 2758 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 2758. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2758 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 2758

How to fill out IRS 2758

01

Obtain IRS Form 2758 from the official IRS website or through a tax professional.

02

Fill in the identification section with your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

03

Indicate the type of entity for which you are applying for an extension.

04

Provide details about your tax return that you are requesting an extension for, including the tax year.

05

Specify the date you are applying for and the reason for the extension.

06

Review the form for completeness and accuracy.

07

Sign and date the form.

08

Submit the form to the IRS by the deadline, either electronically or via mail.

Who needs IRS 2758?

01

Taxpayers or businesses that need additional time to file their tax returns.

02

Individuals who require an extension for specific types of tax returns governed by IRS regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS statute extension?

The extended assessment statute allows the Service time to properly complete the examination of the tax return and to make any additional assessment or reduction in the previously assessed tax liability that is required.

How long can IRS extend statute of limitations?

By signing a waiver of statute of limitations, the CSED can then be extended by no more than five years. The IRS can only request that you sign the waiver if it is in conjunction with a filed installment agreement.

What is an extension of statute of limitations IRS?

Sec. 6501(c) allows the IRS and a taxpayer to consent in writing to extend the statute of limitation to assess tax. Usually the Service makes the request to extend the limitation period because it cannot complete an examination within the normal three-year period for making an assessment against the taxpayer.

What form do I use to file an extension for a trust?

File IRS Form 7004 with the IRS to obtain an extension for 1041, U.S. Income Tax Return for Trusts and Estates. Once Form 7004 is accepted by the IRS, the Trust or Estate is granted up to 6 additional months to file their 1041 tax return.

What is form 2758 used for?

Use Form 2758 to request an extension of time to file any of the returns listed under line 1a, page 1. When to file. File Form 2758 by the regular due date (or the extended due date if a previous extension was granted) of the return for which an extension is needed.

What is the IRS statute extension form?

What is Form 872? Form 872 is a simple form invoice in which the Taxpayer agrees to extend the statute of limitations through the following year (usually), to allow the IRS sufficient time to work the case. They are commonplace in nearly all VDP cases.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

Fill out your IRS 2758 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 2758 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.